Entrance Counseling is required for first time borrowers and for students who have transferred to Morrisville from another college. Students complete entrance counseling to learn about their rights and responsibilities as a borrower. Entrance Counseling can be completed online at www.studentaid.gov

Complete Online Direct Loan Entrance Counseling

Exit Counseling is required when you graduate, leave school, or drop below half-time enrollment and have borrowed federal student loans from SUNY Morrisville. When withdrawing from school, SUNY Morrisville will use your withdrawal date to calculate any return of federal funds. If you do not officially withdraw, SUNY Morrisville will use the last date of attendance. Exit counseling provides important information you need to prepare to repay your federal student loan(s) and must be completed even if you are transferring to a new institution.

Exit Counseling will explain your rights and responsibilities as a federal loan borrower. It also provides information and terms to help you make the right choices about repayment. During the counseling you will review your total federal student loan debt. As you complete the Exit Counseling, pay special attention to:

- Loan consolidation

- Loan deferment

- Payment options (standard repayment, extended repayment, graduated repayment, and income contingent repayment)

- Loan forbearance

Complete Online Direct Loan Exit Counseling

Nursing Exit Counseling: Nursing Loan Borrowers will receive an Exit Counseling packet in the mail prior to graduating, leaving SUNY Morrisville or dropping below half-time.

Repayment Resources

Repayment Plan Options

There are several repayment plans available for Federal Direct Loans, providing the flexibility you need. Here are some things you should know as you prepare for repayment:

- You’ll be asked to choose a plan. If you don’t choose one, you will be placed on the Standard Repayment Plan, which will have your loans paid off in 10 years.

- You can switch to a different plan at any time to suit your needs and goals.

- Your monthly payment can be based on how much you make.

Repayment Estimator

Before you contact your loan servicer to discuss repayment plans, you can use the Repayment Estimator to get an early look at which plans you may be eligible for and see estimates for how much you would pay monthly and overall.

Loan Forgiveness

In certain situations, you can have your federal student loan forgiven, canceled, or discharged. Find out whether you qualify due to your job, disability, or other circumstances.

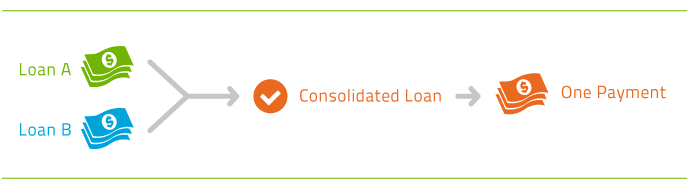

Loan Consolidation

Consolidating your federal education loans can simplify your payments, but it also can result in loss of some benefits. Carefully consider whether loan consolidation is the best option for you. Loan consolidation can greatly simplify loan repayment by centralizing your loans to one bill and can lower monthly payments by giving you up to 30 years to repay your loans. You might also have access to alternative repayment plans you would not have had before, and you’ll be able to switch your variable interest rate loans to a fixed interest rate.

However, if you increase the length of your repayment period, you'll also make more payments and pay more in interest. Be sure to compare your current monthly payments to what monthly payments would be if you consolidated your loans.

You also should consider the impact of losing any borrower benefits offered with the original loans. Borrower benefits from your original loan, which may include interest rate discounts, principal rebates, or some loan cancellation benefits, can significantly reduce the cost of repaying your loans. You might lose those benefits if you consolidate.

If you want to lower your monthly payment amount but are concerned about the impact of loan consolidation, you can consider reevaluating your budget and income situation. You can also consider deferment or forbearance as options for short-term payment relief needs.

Once your loans are combined into a Direct Consolidation Loan, they cannot be removed. The loans that were consolidated are paid off and no longer exist.

Learn more about consolidation so you can weigh the pros and cons and decide whether a Direct Consolidation Loan is right for you.

To ask questions about consolidating your loans before you apply for a Direct Consolidation Loan, contact the Loan Consolidation Information Call Center at 1-800-557-7392. For more information on loan consolidation, click here.

Review your Federal Loans

At any time you can review your federal student loans and grants online at www.studentaid.gov.